The Flourish Journal

Is Business Ownership Right For You?

Is Business Ownership the Right Fit for your client? Business ownership requires the prospective buyer to wear many hats. It is important for clients to know all of the requirements of owning a business.

How Important Are Credit Scores in Franchise Financing?

Credit score and credit history play a major role in a client obtaining franchise financing with great rates and terms. Clients often underestimate the importance of their credit scores when looking for business funding.

What are the benefits of corporate credit cards?

Obtaining and Using Corporate Credit Cards helps business owners manage business expenses and build business credit. Corporate Credit Cards are an excellent choice for short-term expenses. Corporate cards have many benefits, including allowing the owner to qualify without the use of their social security number.

When is an SBA Loan the Right Choice for Funding?

When is an SBA Loan the right loan for a business owner? SBA Loans offer many benefits for owners who meet the eligibility requirements.

Can You Get an SBA Loan for a Franchise?

SBA Loans can help prospective business owners obtain the capital needed to purchase a franchise or other business. Although they have rules and guidelines for qualifying, they offer an excellent vehicle for business funding.

What is the Difference Between a Prequalification and a Preapproval?

Potential borrowers need to understand the differences between prequalification and preapproval when seeking funding for a franchise or business venture.

Advantages of Unsecured Bank Loans

Unsecured Bank Loans can help you obtain the funding needed to start or grow your business. Unsecured Bank Loans offer many advantages for current and prospective business owners.

Credit Card Overutilization: How It Affects Your Chances of Getting Unsecured Bank Loans and SBA Loans

Learn how overutilization of personal credit cards can affect your chances of securing unsecured bank loans and SBA loans. Discover strategies to improve your credit utilization ratio and enhance your creditworthiness.

Unsecured Bank Loan Program for Your 7-11 Franchise

Making your franchise dreams come true

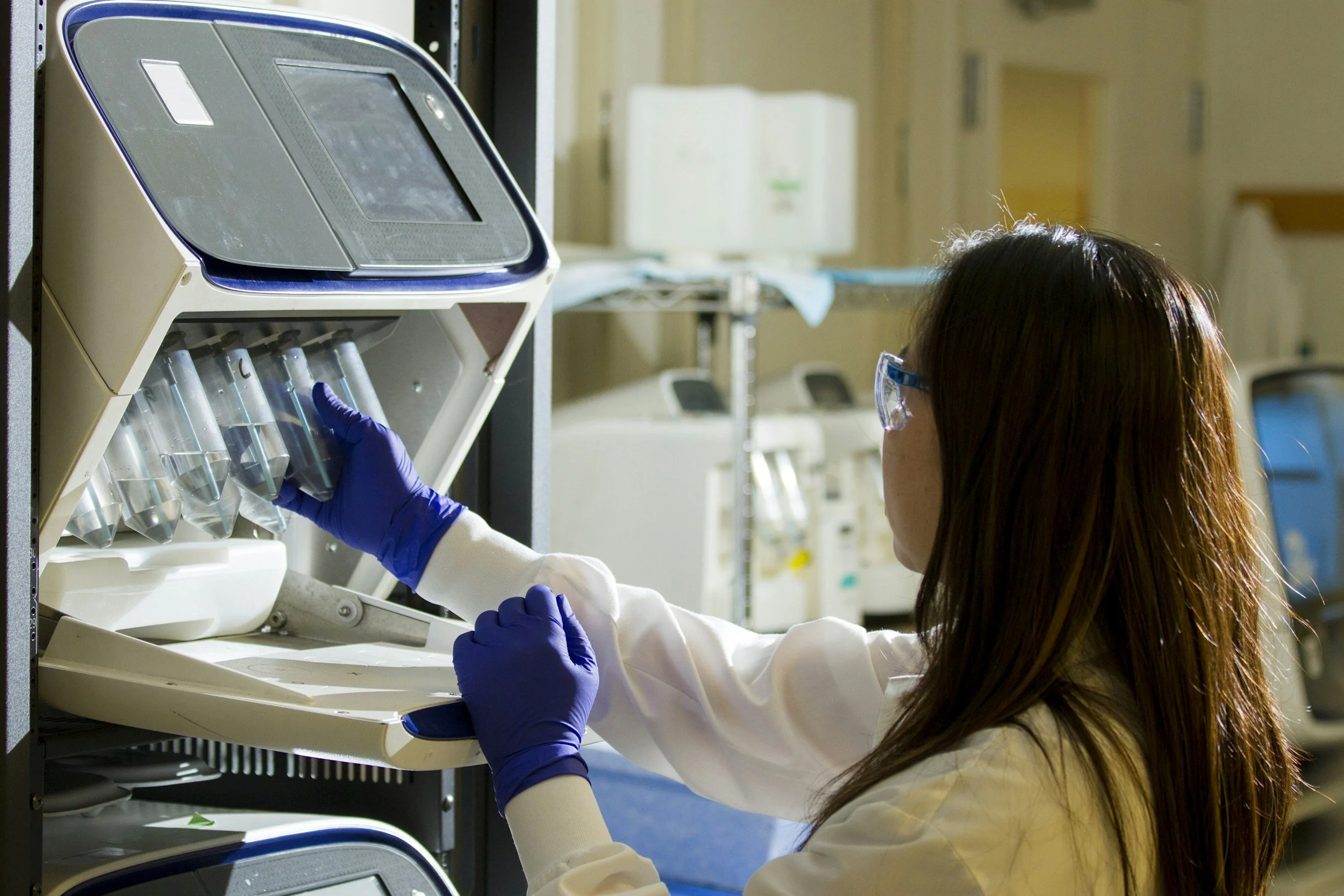

We Offer Financing Options For Medical Professionals

Helping you get the equipment you need for your medical business.